Key Differentiators for P&C Core Platform Home Pages

Are buyers finding us? Is our website engaging? How do we compare with our peers? Coretech CMOs are continually asking these and other critical questions.

Coretech Insight reviewed over two dozen P&C core platform homepages and identified 1,500+ unique keywords and phrases. We cataloged these into 110 themes related to customers, outcomes, product capabilities, and differentiators.

Within the remarkable degree of overlap in content we found key differentiators that should receive more focus from vendors and buyers.

Executive Summary

P&C coretech CMOs and marketing leaders who seek to maximize the effectiveness of their websites continually revisit key questions, such as “Are our ideal customers finding us?” “Are we speaking to their top concerns?” And, “Do we stand out from our competitors?”

To assess the effectiveness of vendor messaging, Coretech Insight reviewed 27 P&C core platform provider home pages. We identified over 1,500 unique keywords, phrases, and statements and organized them into four key topics:

Target Customers

Business Outcomes

Product Capabilities

Differentiators

The overlap in content was remarkable. While there were variations in word choice and turn of phrase, there was a surprising lack of differentiation in vendor core messaging. P&C coretech in the US and Canada is a mature market with dozens of platform vendors. It is challenging for core platform providers to stand out from their peers and too easy to produce content that reinforces a market echo chamber.

While messaging was very similar, there were some key differences. For some vendors, there were critical content gaps, with essential keywords or concepts missing from their home pages. On the positive side, we found examples of creative and unique messaging that effectively conveyed value and helped separate vendors from their competitors.

This article provides an overview of our findings and covers vendor messaging related to these four key topics above. It is intended to be a content management resource for coretech CMOs and marketing leaders. Coretech buyers will also find this to be a useful reference for assessments of vendor marketing collateral and sales pitches.

Recommendations for Coretech CMOs and Marketing Leaders

Use the themes and key concepts covered in these findings to identify strengths in the content of your home page that could be emphasized and gaps that should be filled. Review your messaging to ensure it clearly identifies the customers you serve, communicates the business outcomes you enable, describes key product capabilities, and makes a credible case for why customers should do business with you.

Refine your home page content to identify specific types of insurers within your ideal customer profile, such as mid-size carriers, or MGAs specializing in certain lines of business (LOBs). Most vendors (over two-thirds) failed to identify specific types of insurers best suited for their platforms.

Balance forward-looking speculation on future digital possibilities with content on tangible outcomes that deliver compelling value. Speak to the business outcomes that are the immediate concerns of buyers – growth, speed to market, customer experience, operational excellence, and cost savings – for maximum impact and engagement.

Emphasize quantifiable product capabilities – such as the number of prebuilt integrations, typical timeframes to deploy product updates, or LOBs that are your platform’s strengths – over general statements such as “Next-Gen” or “Future-Ready.”

Highlight verifiable credentials and capabilities and minimize hyperbolic claims about your standing in the industry. To achieve impactful, credible differentiation, provide examples of your implementation successes and the quantifiable business value realized by your clients.

Analysis

It’s hard to assess product options when every vendor sounds the same. Within the market for P&C core platforms, this is a challenge for buyers, analysts, industry observers, and vendors alike. There are common needs across the industry that coretech vendors are attempting to address and common capabilities that should be a part of every set of offerings. At first glance – for example, an initial visit by a potential customer to a homepage – vendors with very different capabilities can appear to be essentially the same.

Coretech Insight reviewed the home pages of 27 P&C core platform vendors active in the US and Canadian markets. Our objectives were to test our anecdotal observations about the lack of variation in vendor messaging, identify examples of strong content and differentiation, and provide our findings as a guide for coretech vendor CMOs, marketing leaders, and coretech buyers.

The homepage is often the first experience an industry professional or potential customer has with a coretech vendor. The variety of homepage designs and depth of content reflects the many different approaches and strategies for engaging with customers that vendors are pursuing. At its core, though, every homepage should answer fundamental questions, such as:

Who are the customers we serve?

What business outcomes do we help our customers achieve? (Or, what needs will we help address?)

What is the nature of and the key capabilities of our products?

What are our differentiators? (Or, why should our customers do business with us?)

In Coretech Insight’s review of vendor homepages, we focused strictly on the actual text on each home page. We did not evaluate website design or use of visuals. Each word, phrase, or statement related to customers, outcomes, products, or differentiators was assigned to one of these fundamental questions and further organized by themes and subcategories.

Question 1: Who are the customers we serve?

Carriers and MGAs were the primary focus of most P&C core platform home pages, with over two-thirds of vendors naming carriers as customers, and nearly 60% identifying MGAs. (See Figure 1 below.) Over 50% also identified “insurers” as their customers. Some vendors used “insurers” exclusively, without specifying carriers or MGAs.

Figure 1. Target Customers

A smaller percentage of vendors highlighted other entities, such as TPAs and self-insureds. Two vendors highlighted their work with startups and insurtechs.

Within the top three themes of Carriers, MGAs/MGUs, and Insurers, most variations were within the category Carriers, which had nine subcategories. Table 1, below, shows these subcategories and the percentage of vendor home pages on which they appeared.

Table 1. Customer Themes and Subcategories

Question 2: What business outcomes do we help our customers achieve?

Most vendors – 70% or more – described business outcomes within five themes: Digital Transformation, Operational Excellence, Growth, Speed to Market, and Customer Experience. (See Figure 2.)

Figure 2. Business Outcomes

Among these themes, the keywords and phrases related to the theme of Growth were the most consistent, with all examples being either “growth” or close variations (such as boosting, expanding, increasing, or improving), or references to growth specifically in premiums, revenue, or sales. Keywords and phrases for the theme of Speed to Market were also very consistent, with 70% of vendors identifying “speed to market” or “time to market,” roughly one-third including adapting to market changes, and 10% emphasizing more proactive responses to new market opportunities.

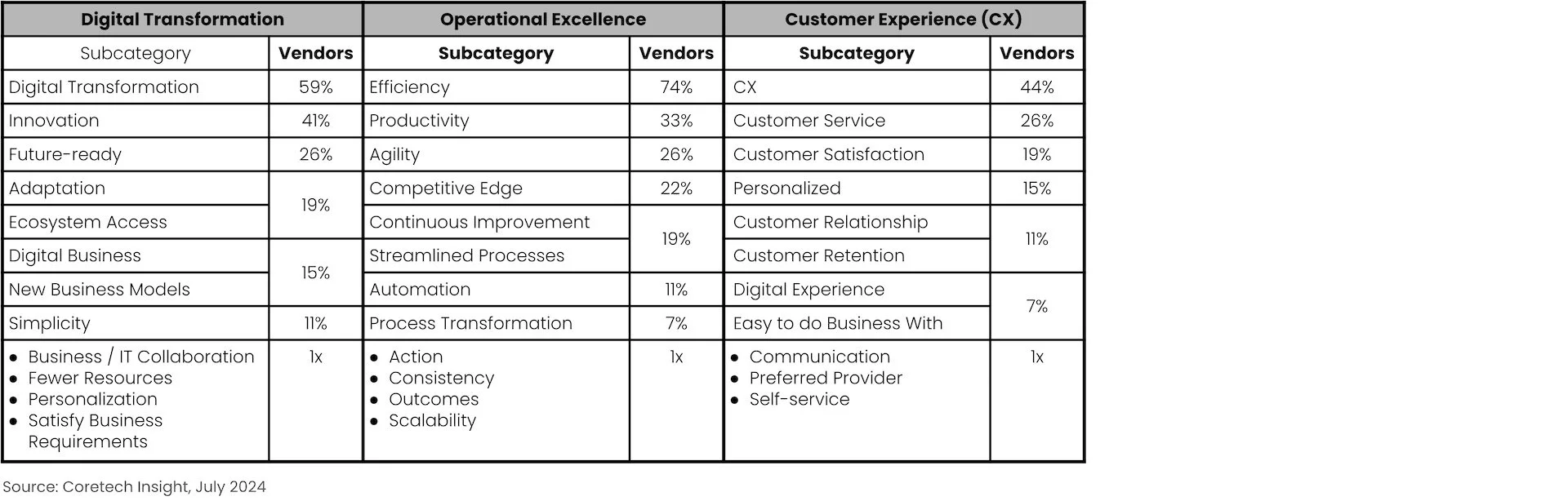

Vendor messaging for the other three of the top five themes was more varied, as shown in Table 2 below. Digital Transformation included keyword and phrase subcategories that ranged from innovation and future-ready to new business models, Operational Excellence included subcategories such as efficiency, agility, and streamlined processes, and Customer Experience included customer satisfaction, personalized service, and customer relationships.

Table 2. Business Outcome Themes and Subcategories

These top five themes align well with insurer buyers’ top priorities. As Figure 2 illustrates, P&C core platform vendors are collectively doing an excellent job of speaking to top customer concerns, balancing future-oriented statements on digital transformation with short-term business priorities of operational excellence, growth, speed to market, and customer experience. However, when assessed individually, about a quarter of the vendors are out of balance and do not fully cover these top themes. Some vendors went all in on the wonders of the digital future with little emphasis on the present. Others were firmly focused on today’s business priorities without regard to future concerns.

Question 3: What is the nature of and the key capabilities of our products?

Among the 27 vendor home pages, Coretech Insight identified 698 unique keywords or phrases that described key product capabilities and organized these into 45 themes. More than half of the vendors published content on the top dozen themes that ranged from core modules to suite. (See Figure 3.)

Figure 3. Key Product Themes

Among the top dozen themes, Core Modules, Configuration, and End-to-end had the most consistent messaging.

Within Core Modules, nearly all vendors identified capabilities for policy (93%), claims (81%), and billing (78%). A smaller percentage, but still a majority at 63%, also identified underwriting and rating capabilities.

Within Configuration, vendors emphasized the speed and flexibility of their configuration tools for general system configuration, new products, and product updates.

When addressing the theme of End-to-end, vendors communicated their ability to “do it all” and provide end-to-end coverage of the policy lifecycle or insurance value chain.

Vendor messaging for the other top themes was more varied. (See Table 3.)

Within the Digital / Modern theme there were many creative statements and varying descriptions – 42 subcategories for this theme alone. However, in the final analysis, these were all variations of a “we’re modern, not legacy” message.

The theme Ecosystem covered vendor investments in APIs and pre-built integrations, and their cultivation of partner ecosystems with third-party solution and service providers. Several vendors quantified this by including their number of partners or third-party integrations.

The theme of Data & Analytics has superseded content on reporting that was more common in the past. Nearly all vendors touted their advanced data and analytics capabilities. Most did not even mention reporting, which is now expected functionality.

Most vendors (78%) promoted their cloud capabilities. Some emphasized cloud-native, and a few highlighted their partnerships with AWS. Surprisingly, some vendors had zero home page content on the cloud.

Similar to Data & Analytics vs Reporting, more vendors are using the term “platform” (74%) instead of “suite” (52%) to describe their core offerings. Only 30% of vendors used the term “core systems.” Coretech Insight expects vendor descriptions of their offerings to continue to trend toward more expansive “platforms” (and “ecosystems”) and away from suites and systems.

Within the theme of LOBs / Products, several vendors confidently claimed their core platforms could support any LOB. Others were more specific, focusing on standard personal or commercial lines, or calling out specific LOBs where they had a strong track record.

Surprisingly, more than one-third of vendors had no content on either the digital experience (DX) for policyholders, or on their support for automation. Content on DX-Policyholders emphasized portals and mobile capabilities, and 24/7 availability with self-service. Within the theme Automation, vendors emphasized streamlined workflows, business rules, and straight-through processing.

Table 3. Product Themes and Subcategories

On the surface, with nearly 700 keywords, content on product capabilities may appear diverse. However, the top dozen themes shown in Figure 3 are found in a strong majority of home pages — from over half to nearly 100%. These dozen themes account for 80% of the product keywords.

From a buyer’s perspective (especially those in early, exploratory phases) every vendor is promoting a modern, cloud-based platform with core policy, billing, and claims modules, data and analytics, and a partner ecosystem. Most also emphasize flexible configuration and product management, support for a range of LOBs, mobile and portal capabilities for policyholders, and end-to-end process automation.

With few exceptions, such as unique capabilities for distribution, multinational operations, or a focus on a market niche like takeouts software, the other product themes will resonate less with buyers and provide vendors with minimal effective differentiation. Certain themes, such as “low code / no code” and “AI,” have been liberally used (across many industries) for product washing with “magic” marketing words. Use of these without specific use cases and quantifiable results may trigger skepticism from discerning buyers. Other themes are no longer differentiators for core platforms and can reflect architectural limitations, for example Reporting, Accounting, All-in-One, and Document Management. Buyers may view an emphasis on these as warning signs of a mature offering that is on its way to becoming a legacy system.

In order to connect with buyers and improve search engine optimization (SEO), coretech vendors should focus on the top themes and subcategories that are the primary concerns of their ideal customers. Where possible, these capabilities should be quantified (for example, by including the number of supported integrations, or by naming supported LOBs) to move beyond general statements and substantiate their product capabilities.

Question 4: What are our differentiators? (Or, why should our customers do business with us?)

For differentiators, most vendors focused on their customers, industry experience, implementation success, and technical / product knowledge. (See Figure 4.)

Figure 4. Vendor Differentiators

All but two vendors included information on their customers in the form of customer logos and quotes. Most (over 60%) combined customer logos with customer quotes with valuable details. The remaining used a less effective approach of showing customers logos only, without any other details to provide context.

Among the other top themes of Industry Experience, Implementation Success, Implementation Resources, and Tech Knowledge / Product Development (See Table 4), there was very similar messaging and fewer unique differentiators. Most vendors promoted their years of industry experience, successful implementations backed with qualified resources, and their product knowledge and technical expertise. The most significant difference was between vendors who included this messaging, and the other vendors (for some themes more than half of vendors) who did not.

Table 4. Vendor Differentiators Themes and Subcategories

The most effective and impactful differentiators were those that could be quantified, such as the number of customers, the number of recent successful implementations, and the number of implementation partners. One vendor shared a very effective set of metrics covering their implementations and the collective business results their clients had achieved. Use of verifiable and quantifiable differentiators not only helps separate a vendor from the pack, but also makes it more difficult for competitors to “get off easy” with broad, unsubstantiated generalizations.

Lastly, only one vendor made a credible claim of 100% implementation success, with all of their implementations (over two dozen publicly announced clients) successfully reaching go-live and use in production. This vendor was also the only provider who stated they would charge no SaaS subscription fees until their clients had successfully gone live on their system.

Conclusion

When vendors apply these findings, there are two extremes they should avoid. At one end of the spectrum, a vendor could attempt to pack their home page with every keyword in use in the P&C coretech market in an attempt to maximize SEO. However, this will dilute their unique positioning and cause them to be lost in the large crowd of vendors. At the other extreme, a vendor could avoid common terms and attempt to establish completely unique positioning. Unusual and uncommon terms, though, will make it more challenging for buyers to find the vendor, may confuse buyers, and may cause buyers to question the vendor’s industry knowledge.

Coretech vendors should seek a balance between typical buyer requirements and industry terms and unique differentiators. Vendors should use common terms for the insurers they serve and the business outcomes they enable so buyers can more easily identify them as a potential solution. Vendors should also communicate that their platforms include essential and expected core platform capabilities, such as:

Cloud-based deployment

Core modules for policy, billing, and claims management

Portals and mobile apps for agents and policyholders

Data & analytics

A partner ecosystem

After confirming their focus on desired business outcomes with a capable platform, vendors can more effectively share their compelling customer examples and promote the unique product and service capabilities that separate them from their peers.

Recommendations for Coretech CMOs and Marketing Leaders:

Use the themes and key concepts covered in these findings to identify strengths in the content of your home page that could be emphasized and gaps that should be filled. Review your messaging to ensure it clearly identifies the customers you serve, communicates the business outcomes you enable, describes key product capabilities, and makes a credible case for why customers should do business with you.

Refine your home page content to identify specific types of insurers within your ideal customer profile, such as mid-size carriers, or MGAs specializing in certain LOBs. Most vendors (over two-thirds) failed to identify specific types of insurers best suited for their platforms.

Balance forward-looking speculation on future digital possibilities with content on tangible outcomes that deliver compelling business value. Speak to the immediate concerns of buyers – growth, speed to market, customer experience, operational excellence, and cost savings – for maximum impact and engagement.

Emphasize quantifiable product capabilities – such as the number of prebuilt integrations, typical timeframes to deploy product updates, or LOBs that are your platform’s strengths – over general statements such as “next-Gen” or “Future-Ready.”

Highlight verifiable credentials and capabilities and minimize hyperbolic claims about your standing in the industry. To achieve impactful, credible differentiation, provide examples of your implementation successes and the quantifiable business value realized by your clients.

Jeff Haner co-founded Coretech Insight, an independent advisory firm, in 2022.

Coretech Insight provides research, frameworks, and insights focused on matching P&C insurers with ideal coretech providers so that, together, they can be wildly successful.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience as a coretech customer, analyst, and vendor provides a unique perspective that cuts through the noise and finds ideal matches between insurers and coretech solution providers.

Are you an insurer looking for a reliable guide to core solutions?

Are you a vendor seeking to connect with your ideal customers?

Contact Jeff at jeff.haner@coretechinsight.com